The world of fintech is rapidly evolving, and with it, user expectations are higher than ever. Instant onboarding, seamless payment experiences, and near-zero friction during sign-up have become table stakes. Yet, compliance and security can’t be compromised. That’s where Smart KYC comes in — a new-age approach to user verification that blends regulatory rigor with UX sensibility.

In this article, we’ll unpack how businesses can automate KYC (Know Your Customer) workflows, reduce drop-offs, and deliver an experience users actually enjoy.

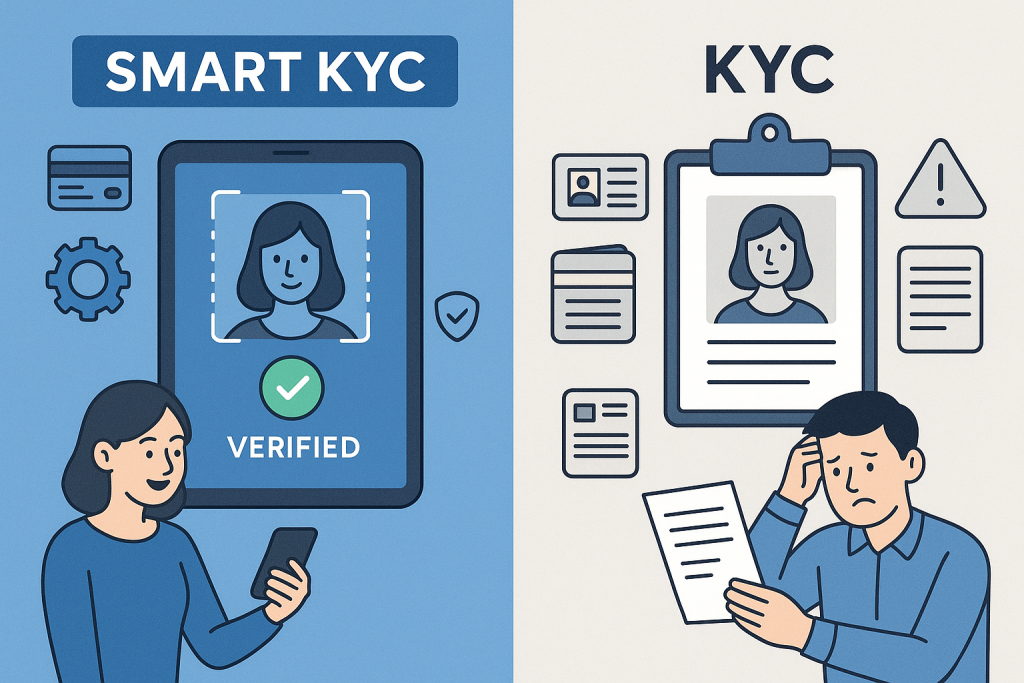

The UX Challenge in Traditional KYC

Legacy KYC flows were never designed with user experience in mind. Think of long forms, document uploads, face-to-face verifications, and week-long approval timelines. These outdated processes often result in:

- High onboarding abandonment rates

- Increased customer support queries

- Regulatory red flags due to manual errors

For digital-first businesses, especially in fintech, lending, crypto, and neobanking, a clunky KYC flow can kill growth before it starts.

What is Smart KYC?

Smart KYC is an API-driven, modular approach to user verification. It integrates real-time identity checks with a UX-first design, allowing businesses to verify users securely without making them jump through hoops.

Core elements of Smart KYC:

- Auto-extraction of data from documents like PAN, Aadhaar, and Passports using OCR

- Biometric verification using face match and liveness detection

- Real-time validation of government databases (e.g., PAN verification, voter ID checks)

- Video KYC, especially useful in jurisdictions where face-to-face verification is mandatory

- Risk scoring, so you can fast-track low-risk users and flag anomalies

These elements are often stitched together using plug-and-play APIs, reducing engineering time and improving compliance reliability.

Why Automate KYC?

Manual KYC doesn’t scale. Here’s what automation brings to the table:

1. Faster Onboarding

Automated flows can bring down the verification time from 2-3 days to under 2 minutes.

2. Lower Operational Costs

Automation reduces the need for large compliance teams and back-office operations.

3. Reduced Drop-offs

When users don’t face friction during onboarding, they’re more likely to complete the journey.

4. Better Fraud Detection

Smart systems can detect anomalies like forged documents, duplicate identities, and location mismatches in real time.

Designing a Smart KYC Flow

Let’s walk through what a well-optimized, Smart KYC flow looks like:

Step 1: Document Collection

Allow the user to snap a picture of their ID. Use OCR to auto-extract name, DOB, and ID number to pre-fill forms.

Step 2: Instant Validation

Ping official databases (like PAN or Aadhaar) via API to validate ID authenticity.

Step 3: Face Verification

Use the front camera to match the user’s face with the ID image. Ensure the flow supports liveness detection to block spoofing.

Step 4: Optional Video KYC

If mandated by regulations, schedule a live agent-based video call or trigger automated video recording with AI moderation.

Step 5: Risk Scoring

Assign a real-time risk score based on geography, device fingerprinting, and historical data to either auto-approve, flag, or reject.

Step 6: Post-Onboarding Monitoring

Even after onboarding, use AML (Anti-Money Laundering) watchlists and periodic KYC refreshes to stay compliant.

Tools & APIs That Make This Possible

The Smart KYC stack typically includes:

- OCR APIs for document scanning

- Face match & liveness APIs

- PAN/Aadhaar verification APIs

- AML & PEP list checks

- IP geolocation and device intelligence

- Risk scoring engines

Leading fintech infrastructure providers like Decentro offer bundled KYC APIs that simplify this integration. With just a few lines of code, you can go live with a secure, modular KYC process tailored to your compliance needs.

Common Pitfalls to Avoid

While building your KYC flow, keep an eye out for these issues:

1. Over-verification

Asking users to submit too many documents upfront creates friction. Only ask for what’s legally required.

2. Poor Mobile Optimization

A majority of users will complete KYC on their phones. Ensure fast load times and intuitive camera workflows.

3. Lack of Feedback

Users abandon when they don’t know what went wrong. Provide clear, actionable error messages.

4. Non-compliance with Data Laws

Store data securely, follow GDPR or local regulations, and offer clear privacy disclosures.

Smart KYC in Action: Real-World Use Cases

Neobanks

Offer 100% digital onboarding, verify PAN + selfie, and go live in under 5 minutes.

Crypto Exchanges

Use document OCR + video KYC to meet stringent AML requirements without slowing down the user.

Loan Apps

Filter high-risk borrowers upfront using risk scores tied to their KYC data and behavior.

Gig Platforms

Verify delivery agents or gig workers quickly before they start onboarding customers.

What Lies Ahead: The Future of KYC

As AI and regulatory tech (RegTech) mature, KYC will evolve into a continuous process rather than a one-time event. Here’s what to expect:

- Continuous KYC (cKYC): Ongoing checks based on user activity, location, and financial behavior

- Decentralized ID (DID): Users control their own verified identity and share on-demand

- No-code KYC flows: Platforms allowing product managers to tweak KYC journeys without engineering effort

- Contextual KYC: Adjust verification steps dynamically based on user risk profile and transaction type

Conclusion

In the fintech era, the trade-off between compliance and user experience is a false one. With Smart KYC, businesses can achieve both — airtight verification and seamless onboarding.

By integrating modular, API-first KYC solutions, companies save time, reduce risk, and delight users from the first touchpoint.

If you’re building a fintech product and want to get started quickly with pre-verified KYC modules, platforms like Decentro offer plug-and-play solutions that scale with your needs.