In the growing era of technology, where every data is available at the fingertips of the phone, there has been a rise in frauds that have emerged as well. Cybercriminals now try to lure their victims into a scam through various ways where mobile phones are involved. This article will briefly talk about all the mobile phone frauds that scammers are using to trick victims. We are covering every fraud that you, as a reader, have come across at least once. So, without any further ado, let’s dive deeper and understand more.

Mobile Phone Frauds That Scammers Are Using to Trick Victims

Ever got a message or call that pretends to be from the insurance department and asks you to confirm your financial details? Scammers use this and many more tricks to induce an emergency action, such as revealing sensitive information. Scammers are playing mostly on psychological manipulation. Let’s see some of these frauds occurring very frequently in India.

Work From Home Frauds

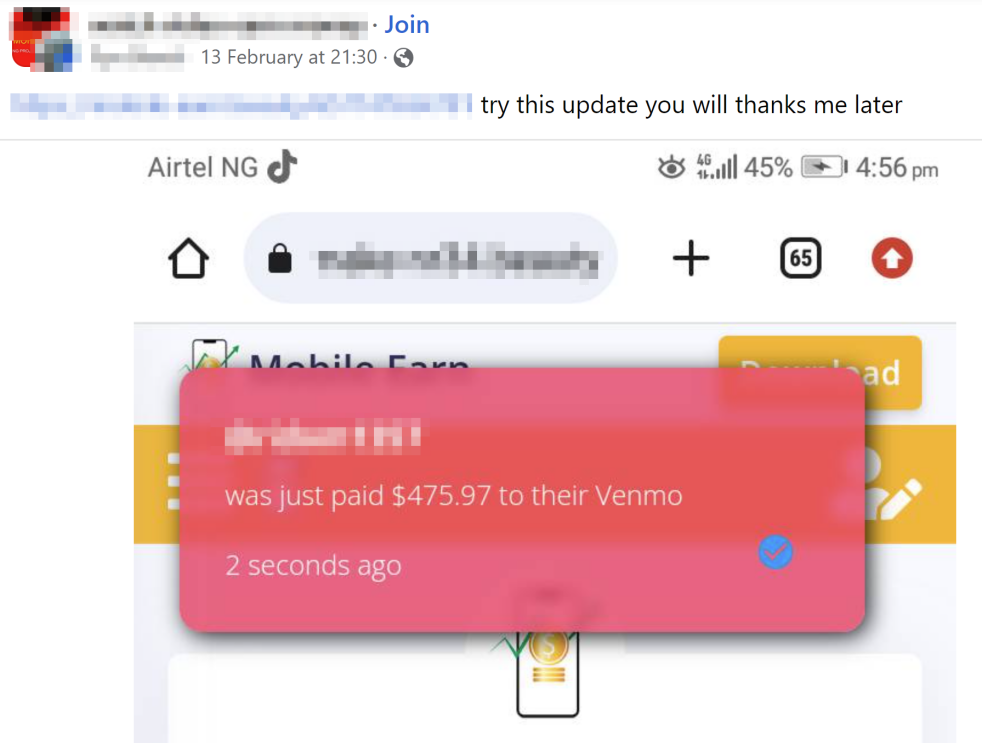

Many social media messages and groups are luring victims by providing an extra income opportunity. The applicants are required to use their mobile phones to work. However, such job opportunities turn out to be potentially fraudulent, wherein they ask for money or involve the applicants in a Ponzi or MLM scheme by drawing investment money.

Sometimes, a small sum of money is given to keep the victims involved in the scam. Also, fake earning screenshots are posted to build trust. However, if the company is not registered and no paperwork is prepared for an appointment, then such opportunities will mostly be scams.

You can see such posts on different social media offering such opportunities as given in the example below.

Lucky Draw Scams

Everyone at least once has got a message saying they have won a lucky draw contest and should contact the sender to claim the reward. Excited victims who are convinced to believe that they are real winners agree to pay a small sum of money to get a bigger reward. This small fee is collected under the pretext of taxes, shipping charges, processing fees, convenience fees, etc.

Sometimes, the fraudsters also claim to be representatives of big organisations and send legitimate messages or calls to make them look genuine. They take advantage of existing lucky draw offers by companies but victims don’t realise that imposters are contacting them under a legit big brand.

UPI Frauds

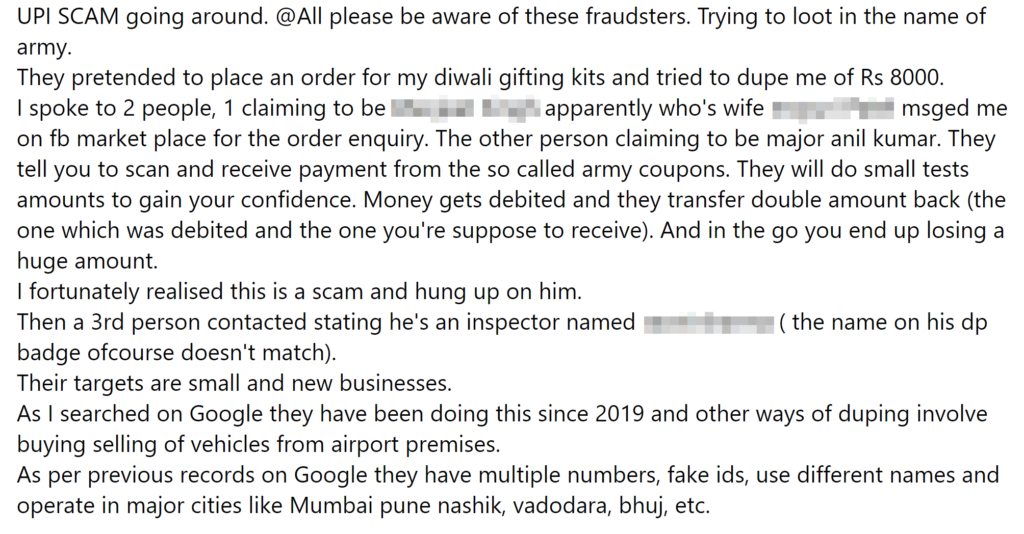

There has been a rise in UPI fraud since mobile-based electronic payment is rising in India. Hackers and fraudsters engage in techniques such as QR phishing, fake UPI set-up, and SIM swapping to conduct a UPI scam.

An extremely common case is where a caller tells the user that they have accidentally transferred a huge sum of money, and asks to return it. However, this alleged transfer is completely fake, and users make a transfer without verifying this claim.

With small business operators, the fraudsters will call to send money. But a ‘receive money’ request is generated instead of ‘pay money’. This is where users believe they’re getting money but accidentally, they are giving the money to malicious people.

More such UPI-based scams are observed in the case of rental premiums, subscriptions, purchasing small goods, cancelled transactions, and accidental transfer of money to wrong accounts.

You can refer to a trending scam going from a complainant on social media.

Fake Apps Downloading

Sometimes, a simple message arrives in your inbox or a WhatsApp message asking you to get an app for free instead of paying its premium. Users are often asked to click a third-party link. The apps, often containing malware or asking for suspicious permissions, then infect the mobile phone. Such malicious apps are programmed to steal credentials, financial, and saved card details.

Some apps also read your SMS, capturing the OTP coming from banking for a transaction and can send it to the criminal who spreads this app. Your mobile phone is then tracked for sensitive activities and the criminal can misuse the captured data for social engineering and other frauds.

Customer Care Fraud

Users often receive calls from scammers who pose to be representatives from insurance, loan, banking, or healthcare companies. They try to remind you about the pending premiums of the past and ask you to pay the amount ‘immediately’ or else there will be termination of the plan. Any unsuspecting user will likely pay it immediately without tracking their premiums. This scam chain originates after the criminals have gathered your data by hacking or checking your internet activities and online posts.

Some companies can even call to offer you a new premium loan from their institution, which, in fact, is a fraudulent entity, offering too good to be true returns or interest. With no valid documentation, they can get hold of your money or push you to pay instantly without giving you much time to think about your actions.

*401# Call Forwarding Scams

This method was recently discovered online, where any criminal tries to convince you to dial *401# followed by a certain number to enable call forwarding. If a victim is awaiting an OTP or an important call from an incoming call, then this will be forwarded to the criminal. Such actions can lead to financial fraud or identity theft. Imagine a scenario where you are awaiting an OTP for a payment transaction. Upon dialing the code and placing someone’s number after it, the OTP will be received at the criminal’s end, who will convince you to enable the call forwarding.

Beware of the Frauds by These Easy Steps

Having known all of the commonly occurring mobile phone frauds that scammers are using to trick victims, it is equally important to understand the steps needed to be taken to prevent the fraud from impacting your finances. Some of the basic understanding of fraud recognition can be shared with less technically advanced people, and here it is as given below:

- Never share OTP over a call.

- Install applications such as Truecaller, which can identify other unsolicited calls and messages. Any number detected on this app as a scam has a high chance of being involved in malicious activities in the past.

- Verify the number that asks you to dial certain codes before typing it. Most legitimate businesses will never ask to enter code while interacting with their customers.

- Other details that you should never share, even to seemingly valid people, over a call or message are credit card details, CVV, account number, passwords, Aadhar and PAN numbers.

- All suspicious activities and if you have faced any scam through the mobile phone should be reported to the carriers and cyber crime cell.

- Any third-party links should be avoided from clicking. Some malicious links commonly appear on WhatsApp, Facebook, and Instagram marketplaces, which might have third-party apps or shop links that are created for fraud purposes only.

- Any contact details that were found associated with malicious shops, apps, or websites should be verified from the Consumer Complaints website, where some victims have already complained about the same scam that you’re currently being targeted for.

Upon reading this article, you must have realised that imposters or fraudsters often hook onto the skill of establishing trust with their victims. Once they convince the victims of their legitimate operations, it is easier for them to trap people in a chain of scams occurring through mobile phones. To safeguard yourself, please remember the above points and stay alert to the trending mobile phone frauds that scammers are using to trick their victims.

Also, users can always engage in a good habit of verifying every message and link on their mobile phone before reacting to it. This can save them from day-to-day scammy operations. Hope you found this article helpful. Were you ever a target for any mobile phone fraud? What steps did you take to protect yourself? Write down in the comments below.

Author Bio: This article has been written by Rishika Desai, B.Tech Computer Engineering graduate with 9.57 CGPA from Vishwakarma Institute of Information Technology (VIIT), Pune. Currently works as Cyber Threat Researcher at CloudSEK. She is a good dancer, poet and a writer. Animal love engulfs her heart and content writing comprises her present. You can follow Rishika on Twitter at @ich_rish99.