My wife, Tracy, is a stay-at-home mum to my two young daughters and son – Ava, age 5, Ella, 2 and Jack 8-months. I have recently started up a loan-matching website SimplePayday. As I am currently restarting this venture we don’t make a large amount of money, so we have to be frugal.

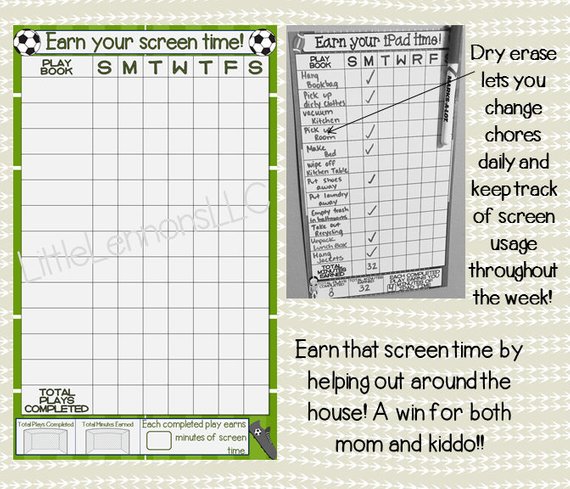

We are trying to pass on our values to our children. Ava gets an allowance every week for the chores she does. We check each chore off on a daily basis and at the end of the week Ava gets paid for doing these chores.

I decided to pay Ava for her chores since this is work she has to do in order to get paid. We actually refer to her allowance as commission since, like a commission, she gets paid for work she does. I use allowance in this story because most are familiar with that term. Most people get paid for work that they complete. I feel that having Ava do some work, albeit minimal work at this point in time, to earn money will help her develop an understanding that work leads to getting rewarded with money. I am lucky enough to drive her to school every day and she knows I go to work and get paid for doing my job. I tell her that she gets paid for her jobs too and wanted to demonstrate this with an easy to use chore chart.

Setting Allowances

We have decided to start off small with the amount we give Ava each week. Right now, it is £1.00. As she gets older and does actual work that is above and beyond what she should do, we will increase the amount she gets.

The chores she does right now are basic ones (cleaning her room, using good manners, brushing her teeth, etc.) that are expected off her. My goal with her allowance at this point is not to reward her for doing things that she should do but, rather, to teach her about handling money. I know her chores are easy for her to do and I want it to be that way. I want her to be able to accomplish all of them so I can have a teachable moment with her every week when she gets paid. When she gets a little older, and the money management tools I am teaching her now are hopefully ingrained in her, more will be expected of her to earn this money.

Savings, Give Away, and Spending Jars

Ava has three jars:

- Savings

- Give Away

- Spending

When she’s paid, Ava puts some of the money in the Give Away container first, then Savings and finally Spending (she knows the correct order and this is very important). I feel that by doing this she will continue this practice later in life.

If Ava wants something at the store, now that she’s five this seems to happen more often, Tracy and I tell her we have to go home and look in her Spending jar to see if she has enough to buy it. We use her Savings jar to save up for items that might cost a little more money. Ava has used the money in her Give Away jar to buy a present for a student at my school who lost her father and for a canned food drive at our church.

A few months ago, she said something that made me so happy. After putting money into each container, she said that she had enough money in her Spending and Savings containers and wanted to get more in her Give Away so she could buy a ball for her 2-year-old sister, Ella. I was so proud of her. She is now of the age that she has started to notice that some of her friends have more materialistic things than she does. We explain as best we can to her why this is so but it definitely made me feel good to hear her say that she wanted more money to give something away rather than buy for herself.

Visuals

One of the reasons that teaching children about money is so difficult is due to the often-abstract nature of money. Few of us use cash anymore, so it can be even more difficult to teach kids lessons about money. There are things you can do, though, to help your child grasp financial concepts.

The use of visuals can be one of the best ways to help your child gain an understanding of money. Here are some visual ways you can help your child learn vital money lessons:

Money Jar

One of the best ways to help your child understand money, and the importance of watching it grow, is with the help of a money jar. The best visual is, of course, something your children can see, so a clear container is a good idea. This way, children can watch as their money adds up. My son loves the big pickle jar that serves as his spending money “bank.” He can easily see how much is in there, and gauge what he has. If you use “matching contributions” to encourage your children to save more, putting them in a jar can be especially beneficial.

Different Jars/Envelopes

Help your child understand that different money is used for different purposes by putting it in different containers. As mentioned Ava has a “spending” jar, a “long-term savings” container, and a container for tithing and other charitable contributions. She knows that all of her money has a purpose, even her spending money. She regularly tapes the picture of some toy to the “spending” jar to remind herself of what she’s working toward as a short-term goal.

Let your child decorate the containers as they wish, and they will feel more ownership for the goal, and more excited about contributing to each of the containers.

Goal Chart

One of the ways we teach Ava about saving for goals was to create a chart. We’d figure out what she got in allowance, and how many weeks it would take her to reach her goal. We created squares for her to colour in — one for each week (or it could work out with one square for each dollar). Ava drew a picture, or cut one out of a catalogue, for the chart. Then had a great time filling in the squares. We also did a variation with stickers when she was going through her sticker phase. She had as much fun filling in the chart as she did actually getting the toy! And the visual really helped her put patience into perspective.

Games and Reading Materials

There are also great games that can visual help children learn about money. My son loves Monopoly. The Game of Life is also a good choice. There are also publications, including Zillions from Consumer Reports, and Quest for the Pillars of Wealth, by J.J. Pritchard, that can be fun — and visual — ways for children to learn sound financial principles.

Author Bio:

Scott is a financial consultant and co-founder of simplepayday.co.uk. The website was started with one vision, to illuminate. Conceived along with the secrets of the brotherhood, they aim to individualise loan quotes for UK residents.

Wow, What a great article even I learn how to manage money from this article. Thanks.