For any business striving to thrive, a payment gateway is an absolute must-have.

After all, speedy payment plays a pivotal role in the triumph of digital transactions and e-commerce success.

Because in the realm of online shopping, customers are renowned for their impulsive buying behaviour. Consequently, prioritising a streamlined payment process can serve as a deciding factor that determines whether or not a sale is made.

In addition, integrating a reliable payment gateway is what helps companies enhance their conversion rate, meet the diverse needs of their customers and generate more revenue.

Before going further, let’s revisit what a payment gateway is.

What is an Ecommerce Payment Gateway?

A payment gateway is what works as a mediator between ecommerce sites and the payment processor. Its major functions involve processing, verifying and determining whether to accept or decline the credit card transaction or direct payments on behalf of the merchant. So, its pivotal role lies in facilitating secure online payments for merchants across websites while providing customers with a secure and convenient checkout experience.

Most of its activities happen behind the scenes of the payment process. Even if the transactions may seem quick and simple, several processes work together to securely transfer funds from a buyer to a seller.

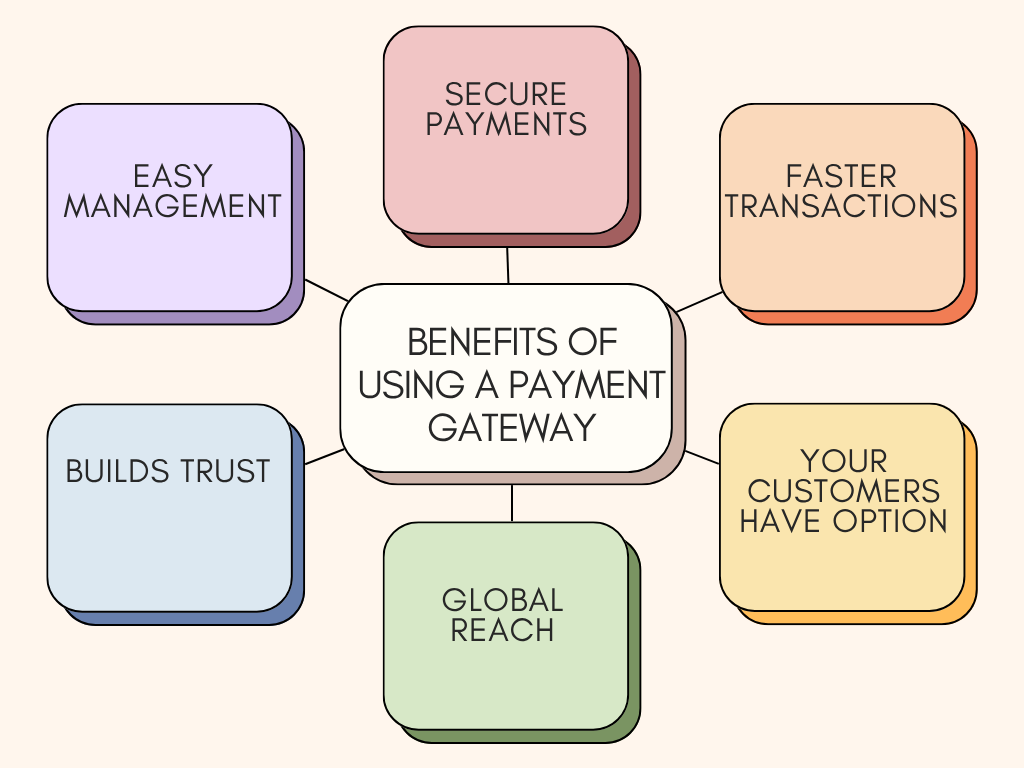

What are the Benefits of Using a Payment Gateway

When you use a payment gateway, it offers some real advantages:

Secure payments: It protects your sensitive customer data through encryption and PCI DSS compliance.

Faster transactions: Unlike manual payments, gateways speed up the payment processing while improving cash flow.

Your customers have option: From cards to digital wallets to buy-now-pay-later options, payment gateways support multiple payment methods.

Global reach: Payment gateways allow businesses to do international transactions in various currencies.

Builds trust: A reliable gateway improves your store’s credibility and customer confidence.

Easy management: Most of the payment gateways offer detailed transaction reports and integration, which simplify bookkeeping and make it easier to track payments, manage refunds, and handle other related tasks.

What to Consider When Choosing Payment Gateways?

You can go over numerous platforms, but picking the best one can be challenging. Some of the most important things to look for in a payment provider.

1. Check the pricing

There can be a couple of services that may require fees and agreements, so study the pricing prior and check whether the required fees fit your budget. The pricing usually varies from one payment gateway to another. As the processing includes multiple financial institutions or organisations, each party charges fees.

Though most services charge a fee per transaction or a percentage of the payment, gateway setup fee to monthly gateway usage fee to merchant account setup, you may have several required fees. Crosscheck the fees with other payment offerings and carefully examine all the pricing agreements to ensure transparency and avoid any unexpected charges.

2. Supported payment options and currencies

When you let your customers pay in their preferred way, you can gain their trust easily while earning more. So, the more payment types your payment gateway can process, the better. Alongside the most common payments, such as Visa and Mastercard, look for platforms that work with others as well, like Apple Pay or Google Pay.

This will make you able to accept multiple payment options, resulting in maximising your customer base. Also, offering payment options such as buy now, pay later, or recurring payments will give you a competitive advantage.

If you sell worldwide, make sure that your chosen payment gateway works globally. Otherwise, you cannot accommodate shoppers with foreign banks. Find out whether the payment gateway offers multicurrency support with or without surcharges.

3. Integration process

It is crucial to identify the available integration option. Payment gateway integration varies depending on the type of gateway utilised. These gateways can be categorised as hosted, self-hosted, or API-hosted. A hosted payment gateway requires the customers to leave a website while making a purchase, while a non-hosted (integrated) gateway allows you to keep your users on your site to make a purchase.

Non-hosted payment gateway providers eventually allow for API integration. For instance, platforms like Shopify, WebCommander, and BigCommerce make integration smooth as they support a wide range of popular payment gateways, from Stripe and PayPal to Afterpay and Zip. Some even come with built-in integrations.

4. Scalability

Often many payment gateways set an upper limit on the transaction amount you can process on a monthly basis. This might not affect that much if you run a small business, but if your business requires a large number of transactions, this limit can be a huge advantage. So, try to find a payment gateway that does not have limited growth options.

5. Security is everything

As ecommerce fraud has become a concerning issue, you need to check how secure is the payment gateway you are looking for. The security of the system is what enables clients to be confident that their financial data will remain secure when acquired from your store.

Check whether the payment gateway is Payment Card Industry Data Security Standard (PCI DSS) compliant and aligned with the highest industry security standards. Because when shopping online, customers want to make sure that their information is safe, and PCI DSS is a series of standards that prevent data breaches and protect cardholder data. Hence verifying that will make you feel confident that you are protecting your customer’s data.

6. Mobile payments

Since today’s customers are using mobile apps over desktops, pick a payment gateway that works well across the mobile alongside the web interface. Find all the information on whether the gateway in your list supports mobile wallets, and if so, then which ones.

But the availability of mobile wallets may vary depending on the country in which your business operates. However, applications such as Google Pay and Apply Pay support all the main credit card networks and operate in hundreds of countries.

7. Holding period

Even if payments are approved immediately, the money is held for a certain time before it is settled in your account. Depending on the payment service provider, the holding time can vary from 1-7 days.

By implementing a merchant account hold, the payment processor gains the ability to temporarily retain funds from your sales while restricting your business’s ability to process transactions. So, make sure to ask about the holding periods and other related policies.

8. 24/7 customer support

Pay attention to the type of customer support that comes with each payment gateway. Such as

- Do they provide support 24/7 or only during business hours?

- Do you get access to phone support?

- Do they support via chat or email?

- Do they offer live technical assistance?

Try to go for a payment gateway with support available to respond to your requests when you need it. Figure out whether there will be a dedicated account manager for your business; if so, make sure the person is familiar with your business case. You have to consider the availability and location of the support team as well so that you don’t require to worry about time zone differences.

Final Words

So, there you have it. Follow the mentioned tactics to narrow down your choices in choosing and executing the right payment gateway. And always prioritise your business objectives and cater to your customer’s requirements while selecting a payment gateway.